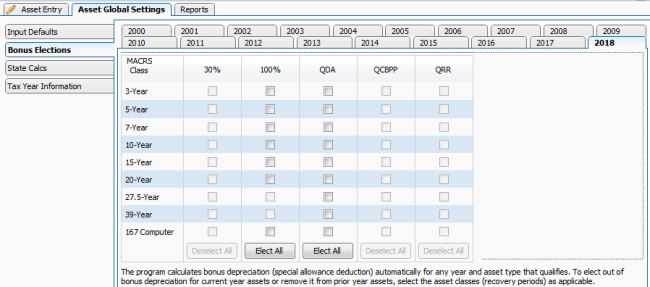

Bonus Elections

ATX inserts a Special Allowance Deduction on the Depreciation and Section 179 Tab for any class of asset to which bonus depreciation applies currently, or did apply in prior years. You can use Bonus Elections to override the default setting by electing out.

A formal elect out statement for the IRS is only required if you are opting out of bonus depreciation for the current year.

If an election statement is required, ATX adds the election statement for you.

Check selections in the Bonus Elections tab to indicate an election out of bonus depreciation for any year and class of property for which the election was made. This allows ATX to remove the default Special Allowance Deduction from qualifying assets.

Bonus Elections tab (Asset Global Settings)

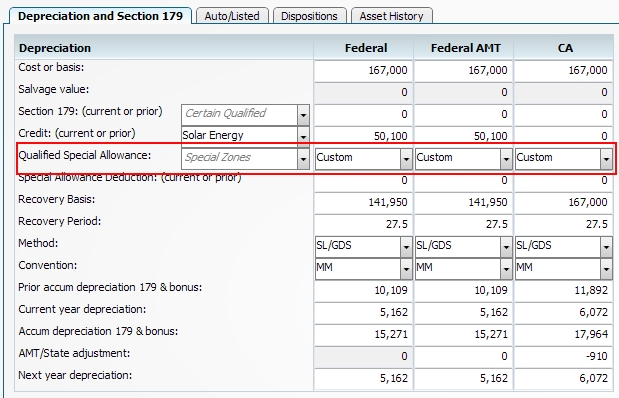

If you need to override the system defaults to either force bonus election or remove the election for individual assets:

- Click the Asset Entry tab.

- Click the Depreciation and Section 179 Tab.

- From the Qualified Special Allowance drop-down list, click Custom.

To make bonus elections:

- Select Bonus Elections under the Asset Global Settings tab.

- Select each MACRS Class that you wish to elect out of for bonus depreciation for each year.

To elect out of all the classes, click the Elect All button located at the bottom of each column.

- Click OK.

See Also: